MyFive Cash Rewards

5% Cash back

on purchases in the category of your choice11% Cash back

on all other purchases1- No annual fee

- Credit lines from $500 to $25,0002

$200 bonus

when you also open a Rewards Checking Plus account and make 3 debit card transactions3$200 bonus

when you also open a Rewards Checking Plus account and make 3 debit card transactions35% cash back rewards in the category of your choice1

Choose your 5% category each month

Groceries

Kroger, Publix, Meijer, Safeway, and more.

TV, Internet and Streaming Services

Netflix, Spectrum, Comcast, Spotify, and more.

Dining

McDonald's, Starbucks, UberEats, Waffle House and more.

Gas and EV Charging Stations

Shell, Exxon/Mobil, Chevron and more.

Travel

American Airlines, Marriott, Hilton, Delta Airlines and more.

Cell Phone Providers

AT&T, T-Mobile, Verizon Wireless, Sprint and more.

More 5% cash back categories

1% cash back on all other purchases

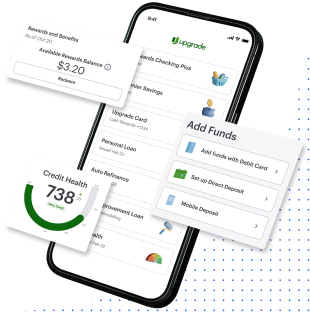

You´re in Control with Upgrade Card

Convenient

Lower cost

And, no annual fee

Predictable

How it works

Apply for Upgrade Card

Tap, swipe, click and go

Make monthly payments

Get rewarded

Lower Cost than Traditional Credit Cards

Each Upgrade Card balance has a fixed rate and term so you know when you pay off your balance and can save on interest. Traditional credit cards can keep you in debt with minimum payments that pay back little of the principal balance.

Bring your balance down faster to pay less interest

Interest paid on a $5,000 balance with Upgrade Card vs. Traditional Credit Card when making a monthly minimum payment

| Upgrade Card | Traditional credit card | |

|---|---|---|

Monthly payment

| $182.66iii | $125.00i

|

Time to pay off the balance

| 3 yearsiii | 22 yearsii

|

Interest paid over that time

| $1,575.71iii | $6,923.09ii

|

Upgrade Shopping

Up to 10% cash back at 1,000s of stores

Use your Upgrade Card to get up to 10% cash back from your favorite brands.6From Our Customers

Upgrade Card FAQs

- What is Upgrade Card?

- Upgrade Card can help you make good credit decisions by combining the flexibility of a cash back rewards credit card with the predictability of a personal loan. Upgrade MyFive Cash Rewards Card is our best cash back rewards card if you want 5% cash back rewards on up to $1,500 in quarterly purchases in the category of your choice. You get to change your category every month, so you can maximize your cash back. Plus you get 1% cash back rewards on all other purchases, when you pay them back.

- How can I use my Upgrade Card?

- You can use your Upgrade Card to swipe, tap, insert or purchase online everywhere Visa® is accepted. You can also transfer credit card balances from other credit card issuers to your card or send funds to your bank account, subject to applicable fees.

- Why choose Upgrade Card instead of a credit card?

- Each Upgrade Card balance has a fixed rate and term so you know when you pay off your balance and can save on interest. By comparison, most cash back rewards credit cards have a low minimum monthly payment. With minimum payments, you tend to pay off less of the principal and may stay in debt for extended periods of time.

- Why choose Upgrade Card instead of a personal loan?

- Upgrade Card gives you the predictability of a personal loan, plus the flexibility of a cash back rewards credit card. You can use your Upgrade Card to swipe, tap, insert or purchase online everywhere Visa is accepted. You have access to funds up to the full line amount, but you only pay interest on the amount that you use. And with Upgrade MyFive Cash Rewards Card, you get 5% cash back rewards on purchases, up to the $1,500 in quarterly spend, in the category of your choice, plus 1% cash back rewards on all other purchases when you pay them back.

With a personal loan, your funds are disbursed in a lump sum once you're approved. If you need additional money, you’ll need to apply again to borrow additional funds. You are responsible to pay back the full amount that you borrow, plus interest, even if you do not use the loan proceeds as you planned. And you do not get any cash back rewards on your loan payments.

- Is the Upgrade Card secured or unsecured?

- Upgrade Card is unsecured so you do not need to provide a cash or security deposit or any other collateral.

- How do I apply for an Upgrade Card?

- Applying for your Upgrade Card is simple and quick. And you can check for an offer with no impact to your credit score or credit report.

First, provide some basic information about yourself and grant us permission to pull your credit report from one or more consumer reporting agencies. This credit pull is a soft inquiry, so it won’t harm your credit.

Then we'll show you if you are pre-approved for Upgrade Card. If you are pre-approved, you will see your offer, which includes your credit line amount, APR and draw length.

- Does Upgrade Card come with Visa Signature® benefits?

- All Upgrade Cards, except for Upgrade Select, offer Visa Signature benefits, including Extended Warranty Protection, Price Protection, Roadside Dispatch, Travel and Emergency Assistance Services and Visa's Zero Liability Policy.7