Find the Upgrade Card That's Right for You

Life Rewards3% cash back Gas, Grocery, and more

No annual fee

No annual fee

Cash RewardsUnlimited 1.5% cash back

No annual fee

No annual fee

Upgrade OneCardPay now or pay later

No annual fee

No annual fee

Upgrade SelectGet the credit you need

$39 annual fee

$39 annual fee

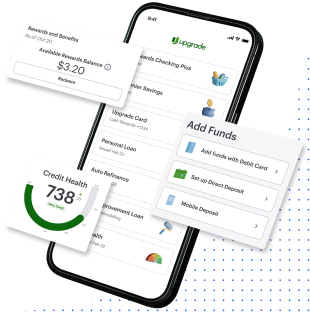

You're in control with Upgrade Card

Combine the flexibility of a cash back rewards credit card with the predictability of a personal loan

Convenient

Lower cost

And, no annual fee5

Predictable

Save on interest over time with Upgrade Card

Each Upgrade Card balance has a fixed rate and term so you know when you pay off your balance and can save on interest. Traditional credit cards can keep you in debt with minimum payments that pay back little of the principal balance.

Bring your balance down faster to pay less interest

Interest paid on a $5,000 balance with Upgrade Card vs. Traditional Credit Card when making a monthly minimum payment

| Upgrade Card | Traditional Credit Card | |

|---|---|---|

Monthly payment

| $182.66iii | $125i

|

Time to pay off the balance

| 3 yearsiii | 22 yearsii

|

Interest paid over that time

| $1,575.71iii | $6,923.09ii

|

i. The minimum payment on a traditional credit card would begin at $125.00 for the first payment and would vary, and decreases, as it’s paid down.

ii. Source: minimum monthly payment calculator available at https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx assuming a $5,000 starting balance, “interest + 1%” minimum payment and an interest rate of 18%, which is approximately equal to the national average rate for good credit (source:https://www.cardrates.com/).

iii. Interest of $1,575.71 assumes a $5,000 charge and installment payments of $182.66 for 36 months. Installment payments calculated with 18% APR and 36–month term accounting for interest accrued between the charge date and the due date 51 days later.

How it works

Apply for Upgrade Card

Tap, swipe, click and go

Make monthly payments

Get rewarded

Upgrade Shopping

Up to 10% cash back at 1,000s of stores

Use your Upgrade Card to get up to 10% cash back from your favorite brands.6

Chip enabled contact-less Upgrade Card

No touch payment is fast, safe, and hassle-free.

Pay with your phone or device by using Apple Pay® or Google Wallet™.

From Our Customers

Need Help?

Email us at

support@upgrade.com