Reach your goals faster with Premier Savings

A savings account to fit your ambitions and your life

Exceptional APY

All the savings, no monthly fees

Insured up to $1 million*

Maximum savings, zero monthly fees

Premier Savings has one of the highest rates in the nation, without the fees that some competitors charge.

| Premier Savings | National Average / Competitor Comparison | |

|---|---|---|

Annual Percentage Yield (APY) | 4.41%1 | 0.45%iii

|

Monthly fees | $0 | $12 to $25i

|

Your interest earnings on a $2,500 deposit

| $110 ii | $11iii

|

i. Range of monthly account fees based on the following competitor products as of June 23, 2023: Chase Premier Savings, TD Select Savings, Wells Fargo Platinum Savings. Account terms may allow for fee waivers when meeting certain conditions.

ii. Assumes principal and interest remain on deposit and interest rate and APY do not change. The estimated values are based on a $2,500 savings amount, are shown for illustrative and informational purposes only, and may not apply to your individual circumstances.

iii. This reflects the average national savings account interest rate of 0.45% as determined by the FDIC as of October 21, 2024 (FDIC National Rates) and applied to a $2,500 savings amount.

High-yield savings account calculator

See how fast you can build up to your goals with our high-yield 4.41% APY¹

Premier Savings account calculatorsSave for

5 years

Total Savings

$661

1 year

$1,352

2 years

$2,073

3 years

$2,826

4 years

$3,612

5 years

Joint Accounts New

New Premier Savings accounts are available as a joint account for two account holders. To open a joint account, select this option when submitting your application.

FAQ

- What is a high-yield savings account?

- A high-yield savings account is a savings account with a higher interest rate than traditional savings accounts. You earn interest for leaving your money deposited in a savings account. This interest is typically expressed as annual percentage yield (APY), a calculation of the total amount you can earn over a year assuming funds are not added or withdrawn. APY is based on compound interest, which is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods. The more often interest compounds, the more money you could earn. Premier Savings accounts accrue interest on a daily basis, with interest credited to your account monthly.

- What are the benefits of a Premier Savings account through Upgrade?

- Premier Savings accounts offer a number of top tier benefits, including:

- Exceptional 4.41% APY on balances of $1,000 or more

- No monthly or annual account fees

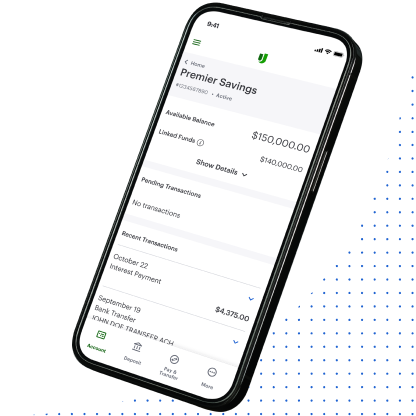

- Secure, 24/7 access to your money

- Real-time alerts and account management via our mobile app

- How do I fund my Premier Savings account?

- Funds can be deposited into your Premier Savings account via standard ACH Transaction or Wire Transfer in U.S. dollars. To initiate an ACH transfer, sign in to your account and select the deposit tab at the bottom of the screen. Here, you can link an external account and initiate an ACH transfer. You can also fund your Premier Savings high-yield savings account by having your payroll provider set up direct deposit to have your paycheck deposited automatically on pay day. If you’re looking to complete a wire transfer, you can direct a third party to transfer money to your account by domestic wire transfer.

- What are the best ways to use a high-yield savings account?

- High-yield savings accounts can serve many purposes, including:

- Building an emergency fund

- Making a major purchase, such as a down payment on a house or car

- Building a college fund

- Major life event - weddings, anniversaries, or starting a family

- Travel - save up for that adventure you’ve been putting off

High-yield savings accounts offer flexibility and earn interest while you work towards your savings goals.

- Who can open a joint account?

- Joint accounts are available to new Upgrade customers or existing Rewards Checking Plus, and Premier Savings customers. Additionally, joint accounts can only be opened with one other person. For example, if you open a joint checking account with one person, that same individual will be the only person you can open a joint savings account with. You won't be able to open a joint account with anyone else.