Pay for your car repairs with a personal loan

- Auto repair loans up to $50,000 at competitive and low fixed rates

- Check your rate in minutes

Checking your rate is free and won’t impact your credit score.

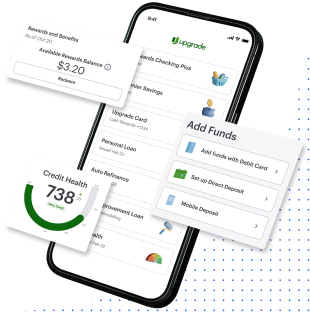

Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Auto repair financing to get you back on the road without breaking the bank.

Get the car repairs you need with fixed-rate financing that has affordable monthly payments.

Reach Your Goals with an Upgrade Personal Loan

Best Personal Loans

Personal loan reviews from our customers

”One of our high interest credit cards had gotten out of hand and was siphoning funds away from our savings goals. It was a responsible step for us to set up a personal loan that will be paid off in a set time period at much less interest. Because of Upgrade, I can now see our family living debt-free.”

It's quick and easy to apply for a personal loan online

Apply online in minutes and see your rate with no obligation or impact to your credit score.

Review multiple loan options and decide which offer is best.

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Upgrade personal loans are flexible & customizable

Select an offer

Choose your monthly payment that won’t ever change and fits your budget.

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees, and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

The 17.98% APR includes:

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

And, each month you would pay back $343.33 over 36 months

Personal Loan FAQs

- What is an auto repair loan?

- While car insurance usually covers the cost of collision-related damage, you're often on the hook for repairs from normal wear and tear. This is where an auto repair loan can come in handy. Auto repair loans are a type of personal loan that you use to pay for your vehicle's repair.

- Why use a personal loan to pay for car repairs?

- A personal loan through Upgrade is unsecured, which means it isn’t backed by property or other collateral. Personal loans through Upgrade have a fixed interest rate so you’ll know exactly what you’ll pay each month and when you’ll finish paying back your loan.

You’ll receive your funds in a lump sum. You can use your money to pay the car mechanic everything you owe for the repairs or spread out your payments over time. You have the option to pay off your loan early, at any time, with no prepayment fees.