Get the money you need for unexpected expenses

- Get up to $50,000 with a low, fixed rate loan

- Affordable monthly payments

- No prepayment fees

- Fast funding†

Checking your rate is free and won’t impact your credit score.

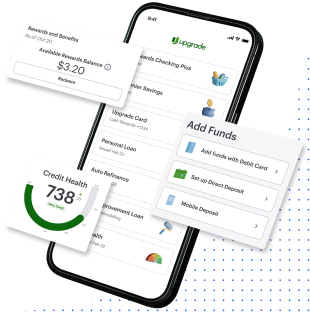

Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Cover an unexpected expense with a personal loan

Why get a personal loan for an unexpected expense?

- Find out your rate and how much you qualify for in minutes with no obligation and no impact to your credit score.

Check your rate in minutes

- You should receive your funds within a day of clearing verifications.

Fast funding†

- Low interest rates with fixed terms so you know how much to budget each month and circle the date for when you’re debt free.

Cover unexpected expenses with a low, fixed monthly payment

Personal loans that make life happen, or cover life's surprises

- Whatever the problem, a personal loan can help you get your home back up and running fast.

Home Repairs

- Get the car repairs you need with fixed-rate financing.

Car Repairs

- Pay for funeral expenses now and pay back the loan in affordable payments over time.

Funeral Expenses

It's quick and easy to apply for a personal loan online

- Check your rate

Apply online in minutes and see your rate with no obligation or impact to your credit score.

- Choose your personal loan*

Review multiple loan options and decide which offer is best.

- Fast funding†

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Personal loans through Upgrade are flexible & customizable

Select an offer

Choose your monthly payment that won't ever change and fits your budget.

- Loan Amount

- $15,000

- APR

- 12.66%

- Term

- 36 months

- Monthly Payment

- $449.50

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

- Your APR

The 17.98% APR includes:

14.32% yearly interest rate5% one-time origination fee ($500) - Your money

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

- Your payments

And, each month you would pay back $343.33 over 36 months

What customers are saying: unexpected expense loan reviews

”One of our high interest credit cards had gotten out of hand and was siphoning funds away from our savings goals. It was a responsible step for us to set up a personal loan that will be paid off in a set time period at much less interest. Because of Upgrade, I can now see our family living debt-free.”

Unexpected Expense Loan FAQs

Need Help?

Email us at

support@upgrade.com

See if a personal loan is right for you.

Checking your rate won’t affect your credit score.