Make a major purchase

- Loans up to $50,000

- Affordable monthly payments

- No prepayment fees

- Fast funding†

Checking your rate is free and won’t impact your credit score.

Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Reach your goals with a personal loan through Upgrade

Why pay for a major purchase with a large purchase personal loan?

- Find out your rate and how much you qualify for in minutes. No obligation, no cost, and no impact to your credit score.

Check your rate online and in minutes

- You should receive your funds within a day of clearing verifications.

Fast funding†

- Low interest rates with fixed terms. A major purchase loan will give you a clear payoff date that you can circle on your calendar.

Fixed rates and terms

Major purchase personal loans that make life happen

- Plan a one-of-a-kind event and enjoy memories with your loved ones.

Wedding and Special Occasions

- Funds to explore new destinations and expand yourself beyond everyday life.

Dream vacation

It's quick and easy to apply for a personal loan online

- Check your rate

Apply online in minutes and see your rate with no obligation or impact to your credit score.

- Choose your personal loan*

Review multiple loan options and decide which offer is best.

- Fast funding†

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

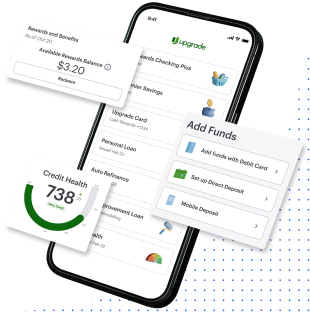

Personal loans through Upgrade are flexible & customizable

Select an offer

Choose your monthly payment that won't ever change and fits your budget.

- Loan Amount

- $15,000

- APR

- 12.66%

- Term

- 36 months

- Monthly Payment

- $449.50

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

- Your APR

The 17.98% APR includes:

14.32% yearly interest rate5% one-time origination fee ($500) - Your money

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

- Your payments

And, each month you would pay back $343.33 over 36 months

What customers are saying: major purchase loans

”Upgrade was able to help me secure a personal loan to help get ahead in life. They were fast and prompt, willing to help me by all means. The representatives were very helpful, friendly, courteous, and I feel went over and beyond to help.”

Major purchase loan FAQs

Need Help?

Email us at

support@upgrade.com

See if a personal loan is right for you.

Checking your rate won’t affect your credit score.