Pay for your dream pool with a personal loan

- Pool financing up to $50,000 at competitive and low fixed rates

- No appraisals or home equity requirements

- Check your rate in minutes

Checking your rate is free and won’t impact your credit score.

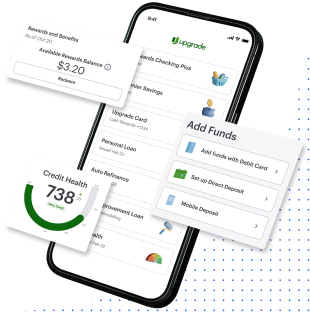

Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Pool financing to increase the value of your home

Turn your backyard into an oasis with swimming pool financing that has affordable monthly payments.

Reach Your Goals with a Personal Loan through Upgrade

Best Personal Loans

Personal loan reviews from our customers

”One of our high interest credit cards had gotten out of hand and was siphoning funds away from our savings goals. It was a responsible step for us to set up a personal loan that will be paid off in a set time period at much less interest. Because of Upgrade, I can now see our family living debt-free.”

It's quick and easy to apply for a personal loan online

Apply online in minutes and see your rate with no obligation or impact to your credit score.

Review multiple loan options and decide which offer is best.

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Personal loans through Upgrade are flexible & customizable

Select an offer

Choose your monthly payment that won’t ever change and fits your budget.

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees, and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

The 17.98% APR includes:

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

And, each month you would pay back $343.33 over 36 months

Personal Loan FAQs

- Why pay for a swimming pool with a personal loan?

- With Upgrade, you can quickly see your rate and how much you qualify for within minutes of filling out an application online, and the funds for your unsecured personal loan are directly deposited into your account within days of accepting your offer and fulfilling necessary verifications.† Plus, a personal loan can provide you with a low fixed rate and fixed monthly payments, so you know how much to budget each month and can circle the date on the calendar when the loan will be fully paid.

With a home equity loan or HELOC, you use the value of your home as collateral, which means you have to first go through the process of getting an updated home appraisal and complete extra paperwork to know how much you qualify for. Plus, using the equity in your home can work against you if property values in the area decline. With a HELOC, you’re issued a line of credit based in part on the difference between your home value and mortgage principal, and the rates on HELOCs may be adjustable, which means your HELOC payments may increase after you receive your money.

Credit cards often have high variable interest rates that can increase at any time. This can make it hard to know the true cost of a project and predict when you’ll be able to pay it off. When a specific project cost is mixed in with other living expenses, it can become even more difficult to plan when it’ll be paid off or even recognize when, or if, it has. With a personal loan through Upgrade, we eliminate those surprises. A personal loan can provide you with a low fixed rate and fixed monthly payments, so you know how much to budget each month and can circle the date on the calendar when the loan will be fully paid.

Read more about the pros and cons of a personal loan, credit card, or other financing options.

- Do I need collateral for a personal loan for home improvement?

- No! With a home improvement personal loan through Upgrade, you don’t need to use your home as collateral. This makes the application process simpler and easier. You can check your rate in just a couple of minutes with no impact to your credit score and for no cost. You can skip the process of getting an updated home appraisal and focus on your home improvement project.