Get up to $50,000 with a low, fixed rate loan

Checking your rate is free and won’t impact your credit score.

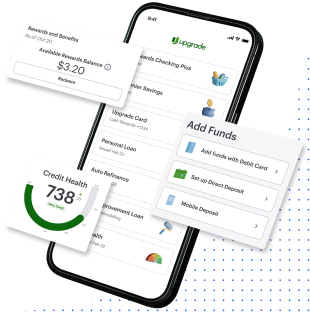

Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Get $200 with Rewards Checking Plus

when you also open an account and direct deposit at least $1,000**Best Personal Loans

”Amazing helpful place with easy self service! 100% recommend these guys to anyone looking for help.”

It's quick and easy to apply for a personal loan online

Apply online in minutes and see your rate with no obligation or impact to your credit score.

Review multiple loan options and decide which offer is best.

Accept your loan offer and you should get your money within a day of clearing necessary verifications.

Flexible personal loan options

Select an offer

Choose your monthly payment that won’t ever change and fits your budget.

Fixed Rate & Term

Pick terms that fit your timeline.

A simple breakdown of a personal loan

Get to know the rates, fees and your payback plan

If you're approved for a $10,000 loan with a 17.98% APR and 36-month term...

The 17.98% APR includes:

You would get $9,500 deposited directly in your account

$10,000 —

$500 = $9,500

And, each month you would pay back $343.33 over 36 months

Personal loan FAQs

- What is a personal loan?

- Personal loans are a form of debt where you borrow money in one lump sum. This sets them apart from credit cards, since credit cards are a type of debt that allows you to borrow money in increments up to a specific credit limit. Personal loans through Upgrade have a fixed interest rate so you know exactly what you’ll pay each month and when you’ll finish paying back your loan.

- How can I use a personal loan?

- You can use a personal loan to achieve a lot of different goals! Whether you want to pay off high-interest debt, finance a home improvement project, make a long-awaited purchase, or something else entirely, a personal loan can help you make it happen.

- Why choose a personal loan through Upgrade over other options like a credit card?

- A personal loan through Upgrade gives you a fixed interest rate that never changes, unlike variable interest rates that change with market conditions. The fixed interest rate eliminates the risk of surprise interest hikes and the set payoff date gives you a clear date that you’ll be out of debt."

- Will checking my rate affect my credit score?

- When you check your rate to see what offers you may qualify for, we perform a soft credit inquiry. It won’t impact your credit score. Once you accept an offer and your loan is funded, we perform a hard credit inquiry. Third parties can see this inquiry and it may temporarily affect your credit score.

- How long does it take to find out if I’m approved for a personal loan through Upgrade?

- We know that waiting to find out if you’re approved for financing can be stressful, and we’re proud to offer an easy application with a fast response. You can check your rate in minutes with no impact to your credit score. You’ll know at the end of your application whether you’ve been approved.

- What discounts does Upgrade offer?

- Upgrade offers a number of discounts! Customers who set up autopay during their application, use all or part of their loan to pay off existing debt, and/or use their car as collateral for a secured loan could all qualify for a discount and save money on their personal loan.

- Do loans through Upgrade have fixed or variable interest rates?

- Personal loans through Upgrade have fixed interest rates, so your rate is locked in once you agree to the loan. This offers stability and predictability you can’t get with a variable interest rate. Variable rates can go up and down depending on different market conditions which can lead to higher-than-expected interest costs, particularly in turbulent economic times when interest rates may fluctuate.

- Are loans through Upgrade secured or unsecured? And what does that mean?

- Secured loans require you to offer something valuable, such as your car, as collateral. If you default on your loan, the collateral you offered may be taken. Alternatively, unsecured loans don’t require collateral, but typically have higher interest rates than secured loans.

Through Upgrade’s platform, you may be offered a choice between an unsecured loan or securing your loan with your car. Either way, don’t be afraid to shop around for the best personal loan interest rate!

- What is the difference between a hard and soft inquiry?

- A hard inquiry, also known as a hard credit pull, is what most people think of when they think of a credit inquiry. These pulls happen when you apply for new credit such as a credit card, personal loan, or mortgage. Hard inquiries usually appear on your credit report and might temporarily impact your credit score.

Soft inquiries or credit pulls, on the other hand, do not appear on your credit report and have no effect on your credit score. Examples of situations that may involve a soft inquiry include lenders pulling your credit to determine your eligibility for pre-approved offers, potential employers performing a background check, or landlords checking your credit when you apply for an apartment.

- How does the loan application process work?

- Upgrade’s application process has three simple steps. First, check your rate online. This takes a couple of minutes and does not impact your credit score. Next, evaluate the offers you qualify for and choose the one that best fits your needs. After you accept a loan offer, your funds will be sent to your bank or designated account within one business day† of clearing verifications.

We hope you’ll find our application process simple, straightforward, and seamless!

- What is the minimum and maximum amount that I can borrow?

- You can borrow $1,000 to $50,000 with a personal loan through Upgrade. If you’re approved for a loan, you should receive your funds within a day of clearing necessary verifications.†

- What is the eligibility criteria for a personal loan?

- Eligibility for a loan through Upgrade is based on several factors, including your credit score, credit usage, and payment history, as well as your loan amount and loan term. To qualify for a personal loan through Upgrade, you must be a U.S. citizen, a permanent resident, or living in the U.S. on a valid visa; be at least 18 years old or 19 in Alabama and other select states; and be able to provide verifiable bank account information and a valid email address.

- What loan terms are available?

- Loans terms offered through Upgrade vary from 24 to 84 months. Once you apply and get approved for an offer, you can decide what loan term works best for you. And remember, you can always pay your loan off early with no hassle or early payoff fees!

- Can I apply with another person?

- Yes! Upgrade accepts joint applications. Applying with another person may help you qualify for a bigger loan and/or a better rate. In a joint application, the credit profiles of both applicants are taken into account and both applicants are responsible for repaying the loan.

- What happens after I check my rate?

- We want to make sure your loan gets to you and no one else! So as we review your application, we may request documents from you in order to verify information such as your income and identity. Having these documents on hand before you apply can help speed up the process. Upgrade will keep you updated and we recommend you check your dashboard for document requests. The faster we can verify your information, the faster we can give you a decision!

- Can I adjust my monthly payment date? How does that work?

- Absolutely! You can always adjust your payment date in your dashboard. Keep in mind that if you extend your billing period by a day or more, you may pay additional interest over the life of your loan.

- How long does it take to receive the funds in my account?

- After you accept your loan offer, you can expect to get your money within 1 business day of clearing verifications. Be sure to check your email or Upgrade dashboard for any document requests, since we may ask for certain documents to verify your identity before finalizing the loan.

- What if I want to pay off my loan faster?

- If you’re ready to pay off your loan before the end of your term we welcome you to do so! Simply make additional payments in your Upgrade dashboard. It’s easy and there are no early payoff fees.

Need Help?

Email us at

support@upgrade.com