What To Do if You Are Declined for Credit

You applied for a personal loan and your application was declined… now what? The road doesn’t end there. What you do after your application is denied is critical and impacts your ability to get the credit you need in the future.

Here are 6 steps to get you back on track to getting the personal loan you need:

1. Find Out Why You’re Declined

There’s no need to guess why your application was declined. Based on the Fair Credit Reporting Act, lenders are required to send you an “adverse action” notice if they decide to deny you credit based on information from your credit report. You could also be denied for a reason unrelated to your credit, like your income or employment history, which lenders will typically inform you about as well.

Read your adverse action notice to learn the exact reason you were declined. Understanding what the lender is looking for can increase your chances of getting approved in the future. Common reasons for rejection include:

- Limited credit history: Lenders want to see your credit history so they can predict your ability to manage your credit with them. The minimum amount of credit history needed to generate a credit score is six months or more on at least one credit account, however, it’s important for lenders to see you have a long and strong credit history. It shows them you have experience managing credit.

- Late payments: A late payment on your credit report from one lender can make other lenders nervous about extending more credit to you. Most negative entries, such as payments over 30 days late, collections accounts and public judgments, stay on your credit reports for seven years.

- Too many credit applications: If you have a lot of recent hard inquiries on your credit report, lenders may consider this pattern of credit-seeking to be a sign of financial hardship or high-risk behavior.

- High debt-to-income ratio: Having a lot of outstanding credit – loans, mortgages or high credit card balances — may make lenders consider you a risky borrower. Lenders will often look at your debt to income ratio to determine if you have the means to manage your debt and pay it back.

- Incorrect information on your application: Entering your driver’s license number wrong or a typo on your residential address could mean the lender is unable to verify your details.

2. Check Your Credit Score

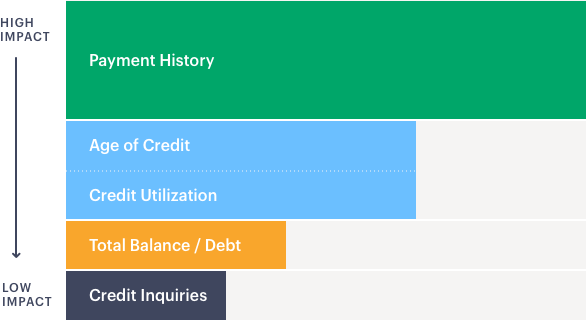

Your credit score is 3-digit number that summarizes the information in your credit report, making it one of the most important factors that impacts your financial future, including your ability to secure affordable credit! One of the first steps to achieving strong credit health and obtaining affordable credit is understanding your credit score and learning the key factors that impact it.

Today, there’s no reason to not know your credit score. There are a variety of websites where you can get your free credit score. Sign up for Upgrade’s Credit Health to get your free credit score plus credit monitoring and credit education tools.

3. Check Your Credit Report

If your loan application is denied because of information on your credit report, you have 60 days to request a free copy of the credit report used in the decision. If you want to see your credit reports from the other bureaus, you'll have to order them separately.

It's important to follow up on this offer, particularly if the adverse action notice mentions a negative record in your credit report that you weren’t aware of, or if your score is lower than you thought it was. Once you order your credit report, you can dispute any errors that may have caused your application to be rejected.

Even if you don’t find anything incorrect, looking at your entire report and all of your accounts can help you see the bigger picture of your credit situation and help you put an action plan in place so you can make steps towards getting the credit you need.

4. Devise Your Action Plan

Once you’ve identified the reasons you didn’t get the credit you requested and reviewed your credit score and credit report, you’re ready to devise your plan. Be prescriptive, realistic and action-oriented. Don’t bury your head in the sand - take the necessary steps to tackle each issue head on.

- Limited credit history: Start building your credit from scratch by finding a way to open at least one credit account. More importantly, take care of that account by making on-time payments so lenders can see that you don’t only have a credit history, but you have a credit history that turns into a strong credit score, too.

- Late payments: Late payments have the biggest impact on your credit score, so if late payments are dragging your score down it’s vital to find ways to make sure that you don’t ever make a late payment again, and quickly pay-off any delinquencies that are currently dragging your score down.

- Too many credit applications: Lay off applying for more credit. When you’re ready to start rate shopping again, take advantage of soft inquiries. Many online marketplace lending platforms allow you to check your rates or see estimated loan offers with just a soft inquiry, enabling you to gather information without hurting your credit score.

- Lower your debt-to-income ratio: While your debt-to-income ratio is not directly tied to your credit score, it is often a factor that lenders consider. Keeping an eye on your debt-to-income ratio and keeping it under 40% is ideal. That often means revisiting your budget and finding ways to pay down your debt.

- Errors in your credit report: More than one in five consumers has an error on their credit report, negatively impacting their credit score and chances of getting better credit opportunities. Get a copy of your credit report and if you discover a problem, dispute it with the three credit bureaus.

Tackling the specific issues you’ve identified that are impacting your score is important, but practicing good everyday financial habits is fundamental to helping you get on track. Here are a couple ways you can build a stronger financial foundation that can support achieving strong credit health and getting the credit you need in the future.

- Create a smart budget: Take a deep look at your finances – your income and the amount you’re spending. Once you’ve created your budget, zoom in more. Are there ways you can cut back and save more so you can pay down debt and lower your debt-to-income ratio?

- Practice better money habits: Tweaking the everyday ways you spend and save can have a big impact on your credit health and score over time. See how improving your money habits can translate into a better credit score and start by automating things you know you need to do every month by enrolling in autopay or setting up payment alerts.

- Get smart about saving: One of the best ways to find extra cash is to be more mindful of your spending habits and avoid getting tricked into buying things you don’t really need.

5. Be Patient

After you start addressing the issues that can help you improve your score – paying off past due accounts, correcting errors, making on-time payments, or taking a break from applying for credit– you obviously want to see the results of your hard work as quickly as possible. You’re undoubtedly wondering, when will my credit score change? Or, when can I start applying for credit again?

Lenders generally update your account information once a month. For that reason, you should allow a minimum of 30 days and up to 45 days for the account information to be reported to the credit bureaus. However, once your credit report is updated with new positive information, there’s no guarantee your credit score will go up immediately or that it will increase enough to make a difference with an application. Your credit score could remain the same, or in some cases it could even go down. It all depends on the significance of the change and the other information on your credit report. And don’t forget, the amount of time information stays on your report varies – it can take more time to recover depending on the severity.

While you’re waiting to see changes in your score, you can simulate how your score will change with Upgrade’s Credit Health. Signing up with Upgrade’s Credit Health gives you access to a credit score simulator, so you can see how your credit score might change if you pay off a credit card or remove late payments.

6. Give it Another Shot

Once you’ve made improvements to your credit situation and if you still need credit, try applying again. Protect your credit score by being smart about how you apply for credit – you don’t want too many hard inquiries to ding your score again! Many online lending platforms pre-approve your application with a soft inquiry, so that is a good first step. To improve your chances, you might want to try these strategies:

- Get a cosigner: If your income or credit were not sufficient to get approved, you might have better odds if you can add somebody else’s income and credit to the application. A cosigner applies with you, and that person will be responsible for repaying the loan. Both you and the cosigner will be responsible for repaying the loan, and both of your credit profiles will suffer if you miss a payment, so only use a cosigner who is willing and able to understand that risk.

- Use collateral: See if there are personal loan companies that offer the ability to pledge something of value to help secure the loan. But first, be aware of the risks. You could lose your home in foreclosure or your vehicle could be repossessed if you fail to make payments. As you should with any money you borrow, only borrow money you know you can realistically pay back.

If your need for credit is urgent, try to be aware and avoid predatory lenders who offer harmful loan terms and can put your finances at risk. Know how to evaluate a personal loan offers so you can make smart choices and get the best loan that fits your needs with terms that won’t damage your credit health over the long-term.

Final Thought

Nobody likes getting rejected, but getting denied for a personal loan presents itself with some opportunities. Taking advantage by securing your free credit report and working towards improving your credit score and overall financial health could help you increase your odds of getting credit in the future. Take the time to mend your credit profile and debt-to-income ratio so you can put your best foot forward when you reapply for credit next time.