Upgrade Card: Revolving or Installment Credit?

Understanding the differences between revolving and installment credit is crucial for managing your available credit mix effectively. Both types can significantly impact your credit score and overall financial health. Let's break down the basics of each and explore how Upgrade Card uniquely leverages installment credit and cash back perks to benefit you.

What is revolving credit?

Revolving credit allows you to borrow money up to an established credit limit, then your credit line generally becomes available to reuse in the amounts you repay on your owed balances . In other words, as long as you haven’t hit your limit, you can keep borrowing. Revolving credit gives you the ability to borrow money when you need it, but it can also cause you to overextend if you can’t afford to pay off the purchases you make.

What is installment credit?

Installment credit accounts allow you to borrow a fixed amount as a lump sum of money and pay it back over time in fixed amounts. Generally, with installment credit, you’ll receive a fixed repayment schedule based on the total original amount borrowed and a fixed monthly payment, which will include both principal and interest. Your fixed APR will likely be based on your credit score and other factors, so having an excellent credit score may help you get more favorable terms and APRs. Once you reach the end of the repayment term or have made all your monthly payments, your installment credit account will be closed.

Is Upgrade Card revolving or installment credit?

Upgrade Card is unique. Upgrade Card is like an installment credit product that includes cash back rewards perks typically found with revolving credit products. So how does it work?

Use Upgrade Card to make in-store and online purchases, just like you would any other card. You’ll earn cash back rewards on every purchase you pay back. Each statement period, your Upgrade Card transactions are combined into an installment plan with a predictable repayment term and monthly payment amounts, much like a personal loan*. That means you’ll know when you’ll pay off your transactions rather than get stuck in a cycle of payments with no end in sight.

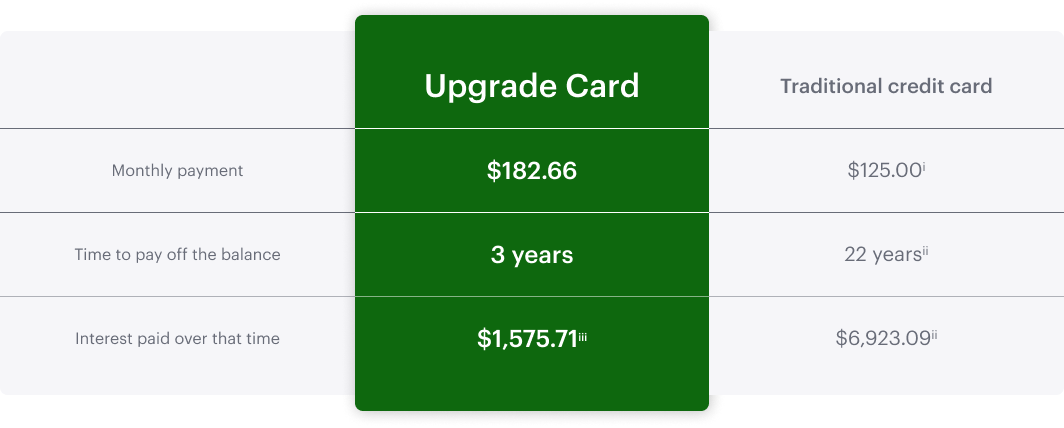

By comparison, most cash back rewards credit cards may have a low minimum monthly payment. With low monthly minimum payments, you tend to pay off less of the principal and may have your balance unpaid for extended periods of time. Alternatively, Upgrade Card’s installment credit product may help you pay down your balance faster and in turn, pay less interest over time. For example, let’s look at how much interest is paid on a $5,000 balance with Upgrade Card vs. a Traditional Credit Card when making a monthly minimum payment and how long it can take to pay off that balance with each card:

- i. The minimum payment on a traditional credit card would begin at $125.00 for the first payment and would vary, and decreases, as it’s paid down.

- ii. Source: minimum monthly payment calculator available at https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx assuming a $5,000 starting balance, “interest + 1%” minimum payment and an interest rate of 18%, which is approximately equal to the national average rate for good credit (source:https://www.cardrates.com/).

- iii. Interest of $1,575.71 assumes a $5,000 charge and installment payments of $182.66 for 36 months. Installment payments calculated with 18% APR and 36–month term accounting for interest accrued between the charge date and the due date 51 days later.

How to Get Started

It’s easy and free to apply for Upgrade Card. Learn more about Upgrade Card and explore different cash back reward perks to find the right Upgrade Card for you. Apply online in minutes and start today.

*Credit Lines feature Annual Percentage Rates (APRs) of 14.99% - 29.99% and line amounts ranging from $500 - $25,000 based on creditworthiness. The lowest rates require Autopay and the majority of line amounts will be $15,000 or under. For example, a $1,000 card purchase with a 36 month term and a 19.99% APR has a monthly payment of $37.55. Optional cash transfers to your bank account and balance transfers are subject to a fee of up to 5% of each draw or transfer. Foreign transactions are subject to a fee of up to 3% per transaction. ATM withdrawal fees may apply. If incurred, these fees will increase your finance charge and APR. A late fee of up to $29 per late payment may apply. Your rate, line amount, and default term depend on maintaining a qualifying credit score, your credit usage history, requested amount, and other factors. The Upgrade Card is unique in that it allows you to obtain a series of closed-end loans which you may access through transactions such as card purchases up to your approved amount. As you repay your balance, additional credit may become available to you up to an approved amount subject to meeting our credit requirements, but your line will not replenish automatically.