The True Cost of Minimum Payments

Paying only the minimum amount due on your credit card may seem like a manageable strategy, but it can cost you much more in interest than you realize. Minimum payments often cover only a small portion of your balance, leading to more interest accrual over time. Let’s explore what happens when you only stick to minimum payments and some solutions to tackle traditional credit card debt.

Interest Accumulation

When a credit card full statement balance isn’t fully paid off each month, the unpaid amount usually incurs interest. This interest is typically added to the balance at the end of each billing cycle, but accrues on a daily basis. With average credit card interest rates at 28.6% in January 2025, much of each minimum payment may go toward paying interest rather than reducing the principal balance. This creates a compounding effect where the remaining principal balance remains unpaid, and more interest accrues resulting in a larger unpaid balance. This cycle can increase credit card debt, making it difficult for you, the cardholder, to pay down what you owe unless you commit to making larger payments that specifically target the unpaid principal (the amount you initially used the card for).

Longer Debt Payoff Period

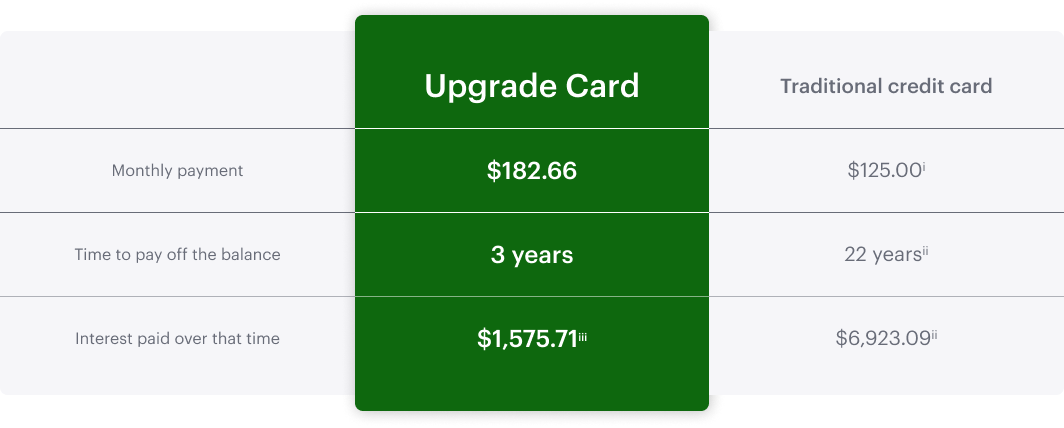

Minimum payments can extend credit card debt repayment by years because of daily interest accrual. For example, a $5,000 balance at 20% interest could take over 20 years to repay if only the minimum is paid each month. In the table below, you can see the cost of interest paid on a $5,000 balance with Upgrade Card vs. a traditional credit card when making a monthly minimum payment.

- i. The minimum payment on a traditional credit card would begin at $125.00 for the first payment and would vary, and decreases, as it’s paid down.

- ii. Source: minimum monthly payment calculator available at https://www.bankrate.com/calculators/managing-debt/minimum-payment-calculator.aspx assuming a $5,000 starting balance, “interest + 1%” minimum payment and an interest rate of 18%, which is approximately equal to the national average rate for good credit (source:https://www.cardrates.com/).

- iii. Interest of $1,575.71 assumes a $5,000 charge and installment payments of $182.66 for 36 months. Installment payments calculated with 18% APR and 36–month term accounting for interest accrued between the charge date and the due date 51 days later.

Alternatively, Upgrade Card combines all of your transactions from a single statement period into an installment plan with a fixed rate and payoff term*, providing a clear end date for your Upgrade Card loan.

Impact to Credit Score and Future Credit Approvals

When you only make minimum payments, the amount of credit utilization on that card might increase. This can increase your total credit utilization ratio, a key factor that affects your credit score, which can have a negative impact on your credit score. In addition, many lenders factor credit utilization into their underwriting process for loan approval—high utilization signals to lenders that you may be overextended and unable to take on more debt.

Increased Stress

Sticking to minimum payments can make you feel like slow or even no progress has been made to paying off your credit card debt. This can add financial stress and may impact mental well-being. Given the strong link between financial health and mental health, the effects may go beyond your finances.

3 Quick Ways to Tackle Credit Card Debt

Knowing the true cost of minimum payments may motivate you to approach credit card debt differently. Here are 3 ways to take on credit card debt:

- Use a debt snowball strategy: Prioritize paying off high-interest debt or small balances to build momentum. Seeing your debt shrink may give you the boost you need to continue tackling it.

- Consider debt consolidation: Consolidating debt can lower your interest rate on your existing debt, which may make it more manageable to pay off. Learn more about debt consolidation personal loans through Upgrade.

- Pay more than the minimum payment: Paying just a bit extra each month—even 10-20% more than your minimum payment—could drastically reduce your overall interest accrual and credit card debt repayment time. If you can pay more than your minimum payment without compromising your ability to pay your monthly expenses, consider doing so to reduce your credit card debt faster.

Understanding the true cost of credit card minimum payments can help you make informed choices to help pay down debt faster and reduce financial strain. Learn about alternative card and loan options through Upgrade and avoid the traditional credit card minimum payment cycle.

*Credit Lines feature Annual Percentage Rates (APRs) of 14.99% - 29.99% and line amounts ranging from $500 - $25,000 based on creditworthiness. The lowest rates require Autopay and the majority of line amounts will be $15,000 or under. For example, a $1,000 card purchase with a 36 month term and a 19.99% APR has a monthly payment of $37.55. Optional cash transfers to your bank account and balance transfers are subject to a fee of up to 5% of each draw or transfer. Foreign transactions are subject to a fee of up to 3% per transaction. ATM withdrawal fees may apply. If incurred, these fees will increase your finance charge and APR. A late fee of up to $29 per late payment may apply. Your rate, line amount, and default term depend on maintaining a qualifying credit score, your credit usage history, requested amount, and other factors. The Upgrade Card is unique in that it allows you to obtain a series of closed-end loans which you may access through transactions such as card purchases up to your approved amount. As you repay your balance, additional credit may become available to you up to an approved amount subject to meeting our credit requirements, but your line will not replenish automatically.