Soft Inquiry vs Hard Inquiry: What’s the Difference and Why It Matters

When you check your credit score or apply for a loan, a credit inquiry is made. But not all credit inquiries are created equal. There are two types—soft inquiries and hard inquiries—and understanding the difference is essential to protect your credit score.

Let’s break down soft vs hard credit inquiries, how they affect your credit, and what to watch out for when applying for credit or shopping for rates.

What Is a Hard Inquiry?

A hard inquiry (or hard pull) occurs when a lender checks your credit report as part of a credit application. Hard inquiries typically require your permission and are visible to lenders. They can impact your credit score, although usually only slightly.

Examples of hard inquiries:

- Applying for a new credit card

- Submitting a mortgage or auto loan application

- Requesting a credit limit increase

- Signing up for a new cell phone plan

Hard inquiries suggest to lenders that you're actively seeking new credit, which could signal financial stress or increased risk.

What Is a Soft Inquiry?

A soft inquiry (or soft pull) happens when your credit report is reviewed without a credit application. These checks do not affect your credit score and are only visible to you, not to lenders.

Examples of soft inquiries:

- Checking your own credit score (like through Upgrade’s Credit Health tool)

- Receiving a pre-approved credit offer

- An employer conducting a background check

- Checking your rate for a personal loan (if no formal application is submitted)

Soft inquiries are used for informational purposes and pose no risk to your credit score.

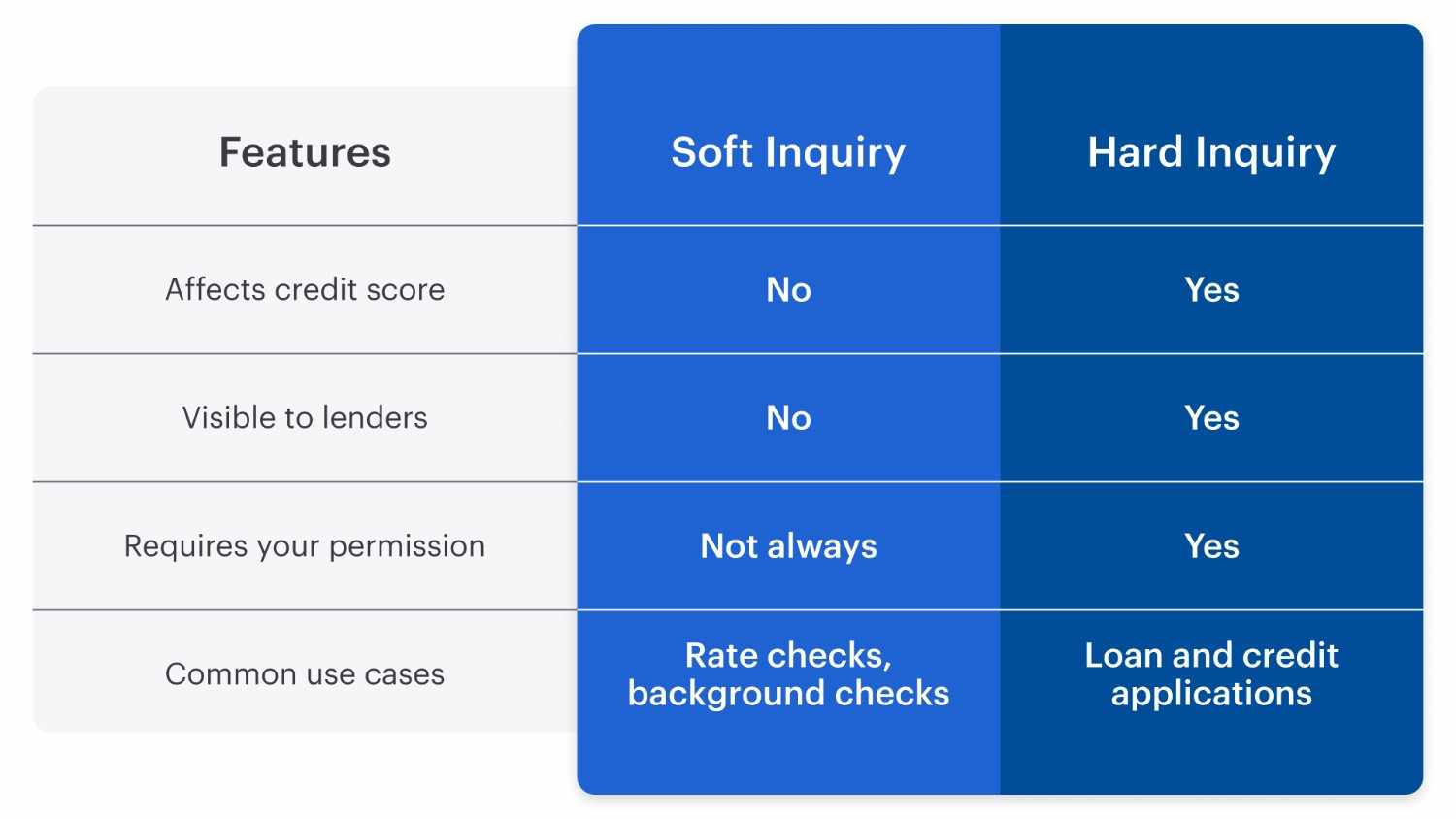

Soft Inquiry vs Hard Inquiry: Key Differences

Only hard credit inquiries can lower your credit score, and typically a few points per inquiry. However, multiple hard pulls in a short time can have a more significant impact.

How Long Do Hard Inquiries Stay on Your Credit?

Hard inquiries remain on your credit report for up to 24 months, but their effect on your credit score lessens with each passing month and is relatively short-lived. In fact, your credit score can typically return to its pre-inquiry level within about six months, assuming no new hard inquiries appear on your credit report and you maintain healthy credit habits.

How to Minimize the Impact of Hard Inquiries

You don’t need to fear hard inquiries, but you can have a strategy to manage their effect on your credit score. Follow these five tips to minimize the impact of hard inquiries:

- Apply only when needed: Avoid unnecessary credit applications to help protect your credit score.

- Use rate shopping windows: Typically, credit scoring models group multiple inquiries for the same type of loan (mortgage, auto loans, and student loans) made within 14–45 days as a single inquiry.

- Use soft inquiries to check rates: Many lenders, including Upgrade, offer pre-qualification with soft pulls only.

- Ask before applying: Confirm whether the lender will perform a soft or hard inquiry. Even cell phone contracts or rental cars can trigger hard pulls.

- Monitor your credit report: Review it regularly for unauthorized hard inquiries at AnnualCreditReport.com.

Final Thoughts

As long as you understand the difference between soft and hard inquiries and take steps to manage your credit wisely, you can shop for the best financial products without damaging your score. Knowing when an inquiry is soft or hard helps you protect your credit and make smarter borrowing decisions.