Everything You Need to Know About Credit Utilization Ratio

Your credit utilization ratio is a key factor in determining your credit score, so it’s crucial to understand how it works. After all, a great credit score can qualify you for higher loan amounts and lower interest rates, while a low credit score can make it difficult to reach your financial goals. So, what do you need to know about credit utilization ratio? We’ve got you covered.

What is credit utilization?

Credit utilization measures the balances you owe on your credit cards relative to the cards’ credit limits. If you never use your credit cards and there’s no balance on them, your credit utilization would be zero. If you typically carry a balance on one or more cards, you are “utilizing” some of your available credit—and credit score providers will take note. Credit utilization is a key piece of your credit score puzzle. Both FICO and Vantage, two major credit scoring agencies, list credit utilization (or amounts owed) as one of the highest factors they consider when determining a credit score. If your utilization ratio is high, it indicates that you may be overspending—and that can negatively impact your score. We’ll talk more about what the best credit utilization ratio is in a moment.

How is credit utilization calculated?

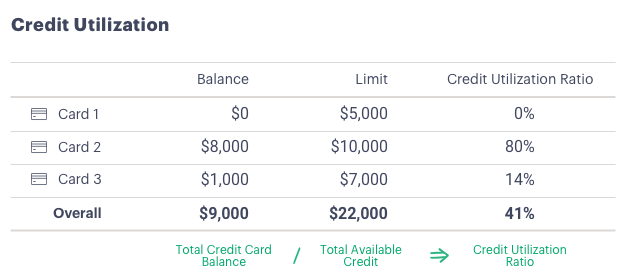

Credit utilization ratios can be calculated for each credit card (your card balance divided by your card limit) and on an overall basis (total balance on all cards divided by the sum of credit limits). For example:

Note that your credit cards are reported at a point in time, not at the end of your statement cycle. So, even if you consistently pay off your statement balance at the end of your statement cycle, having a high balance relative to your limit could also cause you to have a high utilization ratio. You can combat this by always having enough available credit in your other credit lines; this way, your ratio isn’t thrown off completely by one card with a high balance. See more about calculating your credit utilization ratio in the video below.

What is the best credit utilization ratio?

While there is no magic number, the general rule of thumb with credit utilization is to stay below 30 percent. This applies to each card and your total credit utilization ratio. Anything above 30 percent can decrease your credit score and flag to lenders that you may be overextended or have difficulty repaying new debt.

5 Ways to Improve Your Credit Utilization

If you think your credit utilization is holding you back from reaching your ideal credit score, you can use these five strategies to improve it.

1. Pay down debt

Reduce your credit card balances by paying more than the minimum each month. Consider making two or more payments on your credit cards throughout the month—even small, extra payments can speed up debt payoff and help keep your utilization ratio low throughout the billing cycle. Just make sure to avoid charging more on your cards.

2. Refinance credit card debt with a personal loan

Taking out a personal loan to refinance credit card debt can help in more ways than one. Consolidating multiple credit card balances into one loan (ideally with a lower interest rate) can reduce the amount of interest that you’ll pay on that balance over time. This can allow you to pay more toward the principal and eliminate your debt sooner. Debt consolidation loans also make it easier for you to stay on top of payments since it’s a single monthly loan payment rather than multiple credit card payments.

Finally, if you keep your credit cards open after transferring their balance to a personal loan, your credit utilization ratio can improve. Keep the credit cards open and don’t run up a balance on them again and you can improve your credit score over time.

3. Ask for a credit limit increase

You can reduce your credit utilization ratio by asking for a credit limit increase on one of your cards. How does a higher credit limit help your credit utilization ratio? Let’s say you have a balance of $8,000 on a card with a $10,000 limit. Increasing the card’s limit from $10,000 to $15,000 would reduce your credit utilization ratio from 80 percent to 53 percent. The key here is to resist the temptation to spend up to the new limit so you can continue improving your credit utilization ratio.

4. Apply for another card

Another way to increase your total credit limit is to apply for an additional credit card. A word of caution, though: applying for an additional credit card is one way to reduce your credit utilization ratio, but opening a new credit card may not improve your credit score. Having more credit cards may tempt you to spend more than you can afford to pay back, which can wreak havoc on your financial health (not to mention your credit score). Additionally, a new credit card will add to your number of new accounts, which can also affect your credit score.

5. Leave cards open after paying them off

By paying off a card, you’re reducing your total balance or utilization; by keeping the paid-off card open, you’re maintaining your total credit limit—thereby lowering your credit utilization ratio.

Wrap Up

Your credit utilization ratio is just one factor that goes into your credit score, but it’s an important one. Maintaining a low credit utilization ratio can increase your attractiveness to lenders and get you access to better rates. Keep in mind that while taking out a personal loan to consolidate credit card debt, asking for a higher credit limit on your card, or applying for another card can improve your credit utilization, they may all involve a “hard inquiry” on your credit report, which can also impact your credit score.

Now that you know what you can do to improve your credit utilization, it’s important to keep track of your progress. Check your credit card balances monthly and keep tabs on your utilization ratios. Many card issuers offer balance alerts via text or email, making it even easier to prevent your utilization ratio from creeping up. Monitoring your credit score can also motivate you to keep your utilization in check.

Learn more about the factors that go into your credit rating and how to manage your score by using Upgrade’s Credit Health tools. You’ll get access to your free credit score and get personalized recommendations on how to improve it.