Credit Scores 101: How Your Credit Score is Calculated

There are approximately 220 million consumers with credit reports in the United States, and approximately 36 billion pieces of credit data in total are recorded on credit reports every year to create credit scores.1 So, who’s behind the scenes managing the compilation and distribution of all this data that creates the three-digit number that summarizes your credit health?

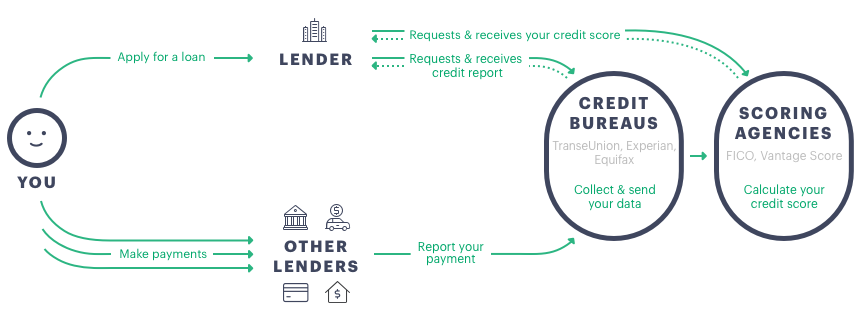

There’s a web of information that is exchanged between a variety of businesses and lenders who all play a role in producing your credit score. Moreover, you can have multiple credit scores that are slightly different because there are multiple credit bureaus, different scoring methodologies and your credit information is often updated at different times.

There’s a web of information that is exchanged between a variety of businesses and lenders who all play a role in producing your credit score. Moreover, you can have multiple credit scores that are slightly different because there are multiple credit bureaus, different scoring methodologies and your credit information is often updated at different times.

Understanding who’s who and how they all work together to create your credit score can be confusing, but we’re here to break it down for you.

Who Creates Your Credit Score?

Credit Bureaus

Credit bureaus, also known as credit reporting agencies, are at the center of creating consumers’ credit reports. Credit bureaus have a dual role—they collect information about consumers’ credit behavior and they distribute it to lenders, businesses and consumers who request it. There are dozens of credit bureaus across the U.S. however the national credit bureaus that are used by the majority of financial institutions and businesses are Equifax, Experian, and TransUnion Credit bureaus collect the input data that feeds into credit score calculations. Each bureau has relationships with different financial institutions and therefore not all loans are reported at all three bureaus. Timing of data uploads to the credit bureaus and different lenders can cause credit scores to be different across bureaus for the same credit score type.

Financial institutions – banks, credit card companies and other lenders

Many people know that financial institutions such as banks, credit card companies and other lenders use credit reports and credit scores to decide whether people qualify for credit, but they also play a big role in creating your credit report.

Any lender with whom you have a trade line, loan, credit card, or other credit account reports information about your account to the credit bureaus. This includes details like the balance of the account, amount due, amount paid, and the status of the account (current, past due, paid, etc.). Additionally, each time you apply for credit and a financial institution requests your credit report from a credit bureau – also known as a “hard” inquiry – this will appear on your credit report and it will be factored in to your credit score .

Note: Some lenders use a soft inquiry in order to show an applicant their initial offers. At Upgrade, when you check your rate for a personal loan we perform a soft inquiry on your credit report, which does not impact your credit score. If you receive a loan through Upgrade, we will perform a hard inquiry, which may impact your credit score. A new borrower may see a small drop in their credit score when they receive a new loan, but the score typically climbs back up with time and on-time payments.

Scoring Agencies

Just like there are multiple credit bureaus, there are multiple scoring models, but the two most common scoring models used to calculate credit scores are FICO Score and VantageScore.

Created in 1956 by the Fair Isaac Corporation to measure consumer credit risk, FICO Score is the oldest credit scoring model. The VantageScore was more recently developed in a collaboration between the three major credit bureaus Experian, Equifax, and TransUnion. Today, the majority of the top lenders and largest financial institutions use FICO and VantageScores. FICO Score and VantageScore both range from 300 to 850 and incorporate five factors into the scoring model, all of which come from your credit report created by a credit bureau. These factors include payment history, amounts owed, average age of accounts, types of credit in use, and new credit.

Final Thought

Now you know all of the key groups involved in creating your credit score and the parts they play, so you can see how important it is to pay attention to all of your finances and credit accounts. Your credit behavior is collected and shared by a number of different groups and it all feeds into creating your credit report and credit score.

It’s easy to keep track of your credit score and the key factors that impact it through Upgrade’s Credit Health – a suite of free credit monitoring and credit education tools. Signing up is the first step to better understanding your credit health and ways you can improve it.